Pensions are a great way to save towards retirement. The eventual size of your pension pot is mainly determined by two things - the total contributions made and the performance of the underlying investments. That’s why it’s important to ensure that you’re invested in the best performing funds within your risk level.

What happens when you add money to your pension pot?

When increasing pension contributions, some of the money that would’ve gone to the Government as tax gets added into your pension instead. This is called “tax relief”. You would receive this tax relief automatically if:

- Your employer takes workplace pension contributions out of your pay before deducting Income Tax. This is called “net pay” and tax relief is automatically given at your highest marginal rate

- You pay contributions from your taxed pay and this is grossed up by the pension provider by basic rate tax. In which case, your pension provider will claim 20% as tax relief from HMRC and add it to your pension pot (which is known as ‘relief at source’)

What happens if you’re in the higher rate tax band?

If you are a higher or an additional rate taxpayer and your contributions are via the relief at source method, you’ll need to take action to get the additional 20% or 25% tax relief. This could either be by completing a self-assessment tax return or contacting HMRC to obtain the additional relief through the PAYE system by an adjustment to your tax code.

Example

Joe is an analyst earning £70,000 per annum. He makes a personal pension contribution of 8% (£5,600) of his salary into his company’s workplace pension and his employer contributes 5% (£3,500). Joe receives the basic rate tax relief (20%) automatically through relief at source.

As Joe is a higher rate taxpayer (paying tax at 40%), he is due a further 20% in tax relief on his personal contribution which is £1,120 (20% of £5,600).

However, this relief is not automatically applied, and so in order to claim the extra £1,120 tax relief, Joe will need to complete a tax return.

In addition, if Joe has been making the same amount of contributions since he joined the firm but has not been claiming the additional tax relief, he can go back 4 tax years. As we are in the 2021/22 tax year, Joe can go as far back as 2017/18 tax year. Assuming he has always been a higher rate taxpayer and his pension contributions remained the same, this would result him in receiving a total of £5,600 (5 x £1,120) in the 2021/22 tax year.

Am I eligible to receive money back?

Ever since the introduction of auto enrolment into workplace pensions in 2012, we have spoken to many new clients who haven’t been claiming valuable tax relief on their pension contributions. This suggests many have been missing out on thousands of pounds.

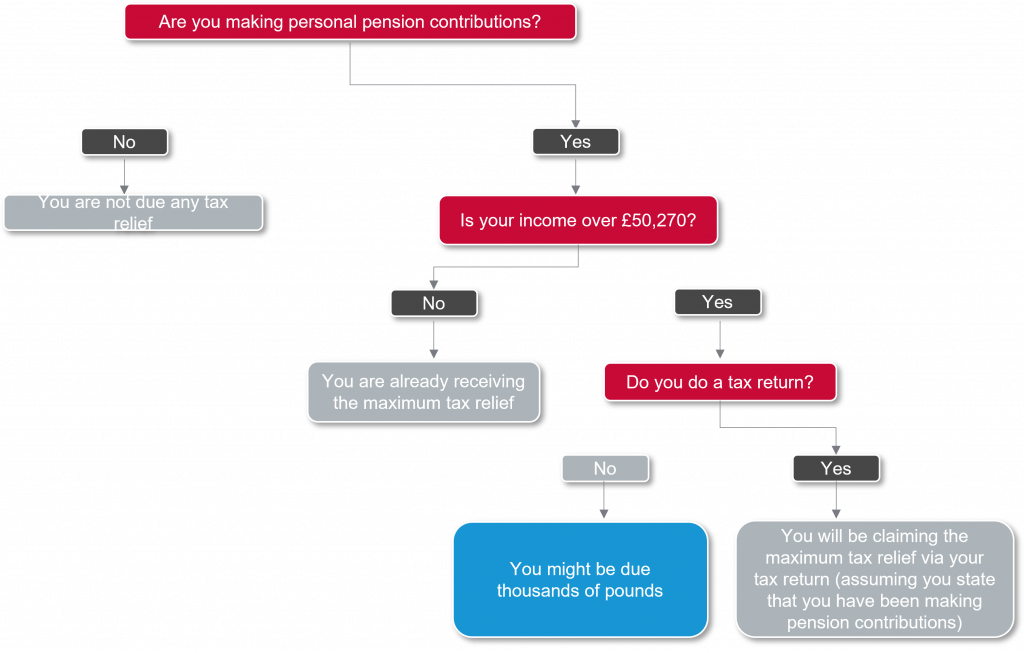

The flowchart below can help you identify if you are due any money back.

Note: you will only be getting a higher rate relief if you have entered the fact you are making pension contributions into your tax return.

How can we help?

If you’re a higher rate taxpayer who makes personal pension contributions but doesn’t complete a tax return, then please get in touch with our Chartered Financial Planner Görkem Gökyiğit (gorkemgokyigit@lfwm.co.uk) for further assistance.