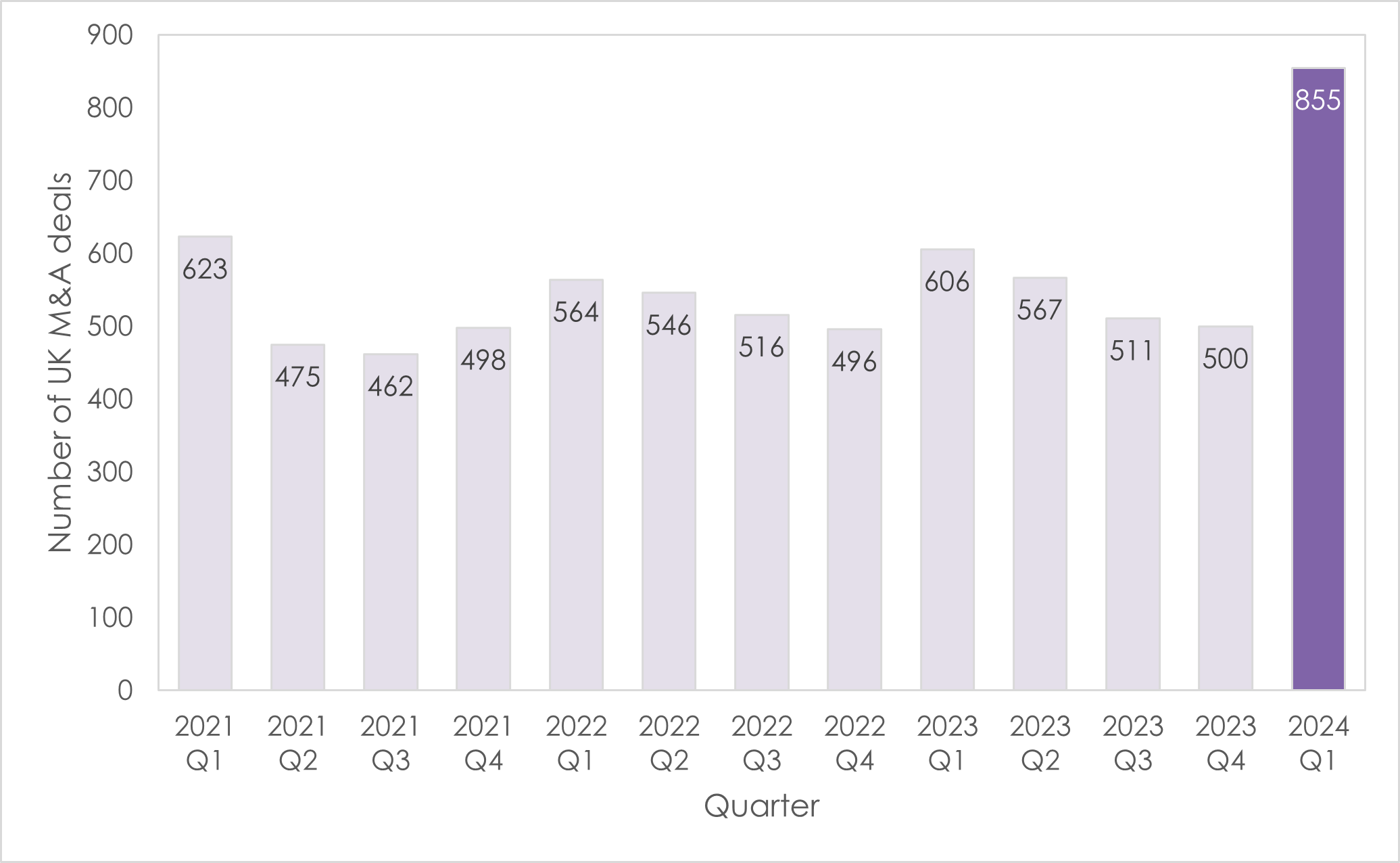

The UK has witnessed a remarkable 71% surge in M&A deals in the first quarter of 2024, with the total number of deals rising from 500 in Q4 2023 to 855 in Q1 2024 (see graph below). This surge is driven by several critical factors, which we will explore in this article.

What is the reason behind this spike?

- Anticipation of Labour's First Budget

One of the primary drivers for this increase is the concern among entrepreneurs regarding the Labour Party's first Budget. There is a concern that Labour may increase CGT, which will increase the tax that an entrepreneur needs to pay on the gains they make from selling their business.

- Potential Changes to Business Asset Disposal Relief (BADR)

Another factor contributing to the rush in M&A activity is the fear of reductions in Business Asset Disposal Relief (BADR). BADR allows entrepreneurs to exclude some of the gains from the sale of their business from CGT. The potential for reductions in this relief has led to a surge in business sales as entrepreneurs aim to lock in current tax benefits before any changes are implemented.

Entrepreneurs lost significant amounts from the sale of their businesses when the tax on the sale of businesses increased dramatically in 2020 (via a reduction in Entrepreneurs Relief – now known as BADR). There is a concern that there may be some repeat of this under Labour.

It’s clear that business owners who were planning to sell have accelerated their timelines. Deals that are already in negotiation are being pushed faster into completion as no one wants to be hit by an unexpected tax bill from a new Government. Many entrepreneurs are basing their retirement income on the post-tax earnings they make from selling their business.

- Other factors fuelling the surge

In addition to a determination by some entrepreneurs to sell their businesses ahead of possible tax increases, there are a number of other drivers behind the increase in business sales:

- It has become easier to secure acquisition finance from banks and other lenders. This is allowing more bidders to progress with deals.

- A weak economy has meant that more vendors/sellers have moderated their expectations of what they will achieve for businesses – ensuring more deals are completing.

- The fall in inflation has improved confidence levels amongst bidders. The moderation of inflation and the fact that interest rates have stopped rising means that bidders can be more confident over the future profitability of businesses that they are planning to buy.

How can we help

At Lubbock Fine, we understand the complexities and challenges involved in selling a business, especially in a rapidly changing economic and political landscape. Whether you’re looking to sell your business or explore acquisition opportunities, we offer tailored solutions to help you achieve your goals efficiently and effectively.

For a confidential discussion, please get in touch with Partner, Stephen Banks (stephenbanks@lubbockfine.co.uk).

Press coverage: