This article is a reminder to care providers that HMRC are targeting perceived VAT avoidance in the care sector. Below, we explain the background to the policy paper issued by HMRC and outline the steps that should be taken by care providers who are concerned their VAT arrangements may fall foul of HMRC’s new policy.

Background

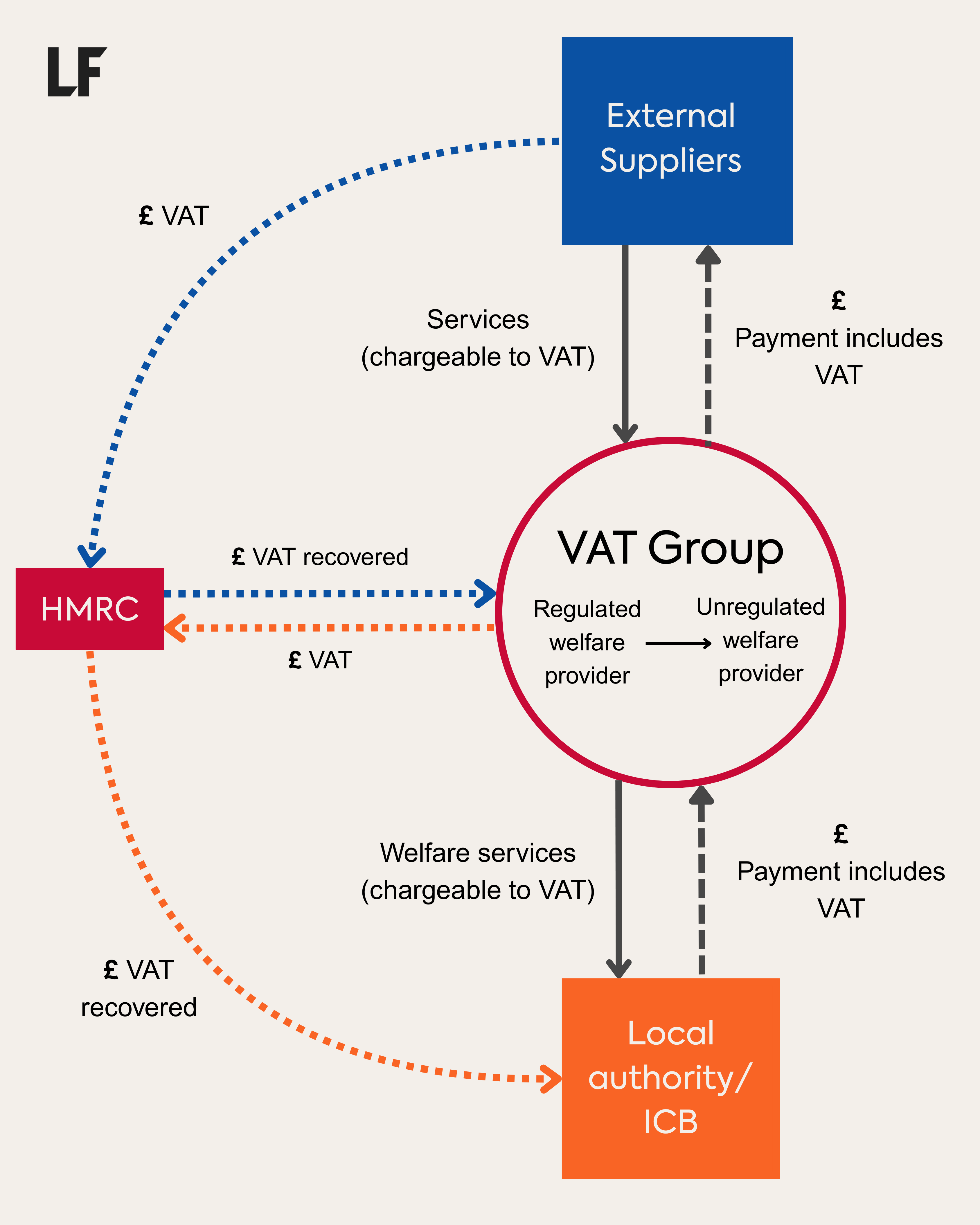

Local Authorities and NHS Integrated Care Boards (‘ICBs’) often engage state regulated care providers, who are registered with the Quality Care Commission, for the provision of residential welfare services. The provision of welfare services by regulated care providers is exempt for VAT. This means that regulated care providers are not required to charge VAT on their services, but also that they are unable to recover the VAT they incur on costs relating to the provision of their services. This irrecoverable VAT becomes a cost to the business.

In recent years, many regulated care providers have implemented a business model which enables them to recover the VAT they incur in providing their services, which would otherwise have been irrecoverable. This involves setting up an unregulated entity, with which the regulated entity forms a VAT group. The Agreement with the local authority is amended so that the unregulated entity becomes the contracting party for the provision of the welfare services. The regulated care provider continues to provide the welfare services, but it is treated as supplying these services to the unregulated care provider, which supplies them on to the local authority or ICB in its own name.

The provision of welfare services by the regulated care provider to the unregulated entity is disregarded for VAT as it takes place within a VAT group. The supply of welfare services by the unregulated provider to the local authority is chargeable to VAT, but this will generally be recoverable by the local authority under special VAT rules that apply specifically to these types of bodies. The VAT incurred by the regulated care provider becomes recoverable since it is attributable to taxable supplies made by the VAT group.

What Is the Issue?

On 24 April HMRC issued a policy paper stating that they consider the growing use of VAT grouping structures by state-regulated care providers to be a form of tax avoidance, which they will deal with accordingly.

They confirm that they will refuse new VAT group registration applications that are designed to implement and facilitate the above.

Furthermore, they have announced that they are launching a programme to review and investigate all instances where it is known or suspected that an avoidance scheme is in operation within a VAT group arrangement and advise that organisations currently using the relevant VAT grouping structures may want to review their current VAT accounting practices independently and get professional advice.

HMRC advise that any businesses with VAT grouping arrangements as described above should contact HMRC as soon as possible.

How Can We Help?

The Lubbock Fine VAT team has extensive knowledge and experience of advising clients in the care sector. We can review your VAT arrangements and advise on whether they are likely to constitute the type of structures that HMRC are targeting. For businesses which are clearly already operating such arrangements, we can review your VAT position and advise on any steps that should be taken and regarding communicating with HMRC. Please contact Sharon Parker at the Lubbock Fine VAT team for an initial confidential discussion.