Three low-risk strategies for the cautious investor

Lubbock Fine, 24 August 2020

Lubbock Fine, 24 August 2020

The recent downturn in the investment markets has presented great opportunities for the long-term investor.

However, as advisers will always remind you, there is no such thing as a ‘risk-free’ investment. Even cash is not protected from the negative effects of inflation, one of the most prevalent (albeit unrecognised) risks of holding money. As an investor, you must therefore decide what level of risk you are comfortable with.

A high level of investment risk is not everyone’s cup of tea and you may have very good reasons for seeking safer havens. If you are a cautious investor and want to only take limited investment risk, or if there is a reason why you do not wish to invest cash, you should be aware that there are alternative options available to you.

Here are three strategies you could consider.

Different types of investments naturally carry differing degrees of risk.

Typically speaking, investing in higher risk assets, such as equities, may mean a potentially higher reward, but with a greater risk of losing money. A lower risk investment, such as fixed interest or government bonds, will generally mean a lower reward, but with a greater degree of security.

If your aim is for your capital to keep pace with inflation, or you would like to adopt a more cautious investment strategy for your capital, then you should be aware that there are lower risk investment alternatives.

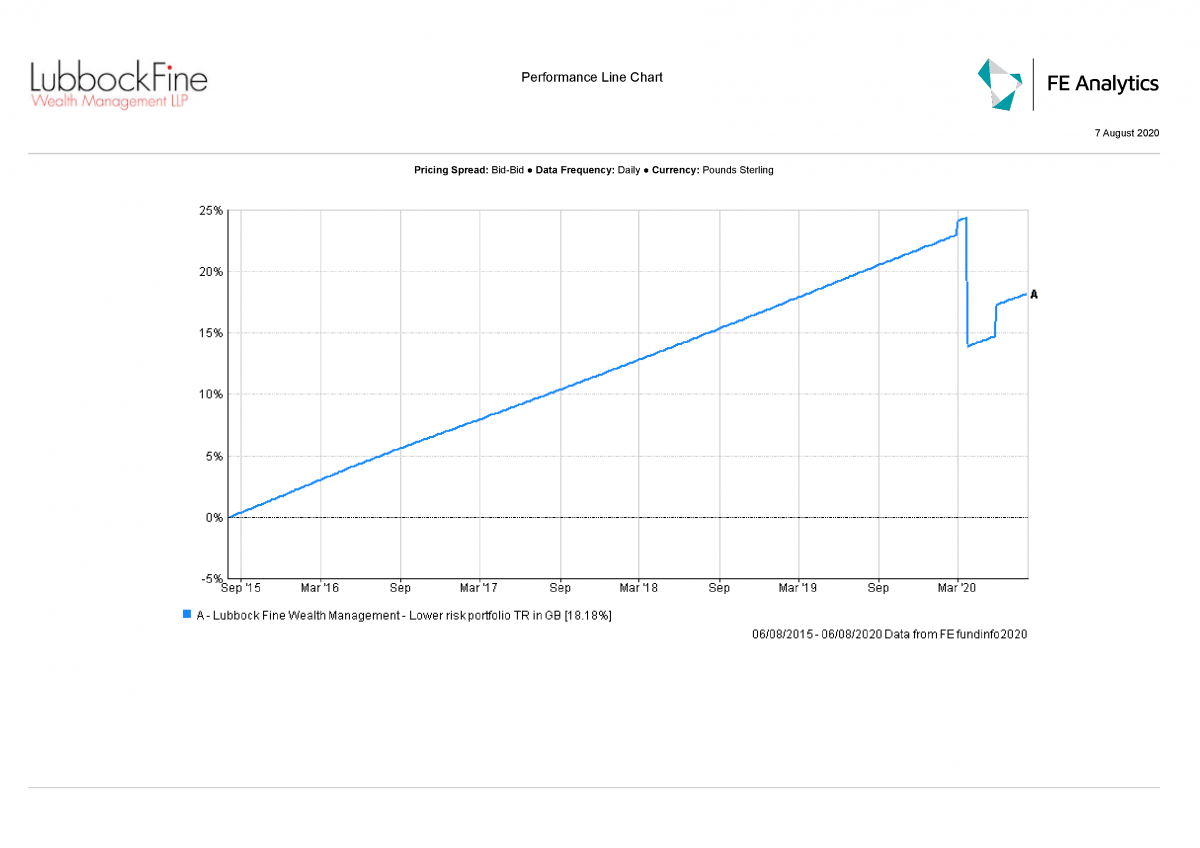

The graph below charts a lower risk portfolio that we use for our more cautious clients over a 5-year period. As mentioned earlier, lower risk investments can still fall in value, but the falls are not usually as sharp as their higher risk alternatives.

Invest on the side of cautious

Disclaimer: Past performance is not an indicator of future results. Investments can go up or down.

There could be times where there are very good reasons not to expose your savings to any investment risk, even ones that seem “low”.

For example, if you need to access your capital in a few years’ time, perhaps to buy property, our advice will always be not to invest. This is because if the investments were to fall, there is not enough time to ‘ride out’ volatile periods, which could mean you have to save for longer or accept a smaller savings pot.

For cash that is set aside for such a purpose, Premium Bonds, issued by National Savings & Investment, is a great alternative.

What are Premium Bonds and how do they work?

Premium Bonds are a type of savings account, but unlike traditional bank accounts, they do not pay interest. Instead, a unique bond number is issued for every £1 invested and each bond is entered into a monthly prize draw where you can win between £25 and £1 million, entirely free of tax.

You can invest up to £50,000 and the capital remains accessible if you need it at any time. It is also 100% backed by the Government, meaning that you are not subject to £85,000 limit offered by the Financial Services Compensation Scheme (explained in more detail later).

With interest rates being at an all-time low, with no prospect of them going back up any time soon, investors and businesses are looking for ways to earn higher interest rates for cash reserves that are set aside for specific purposes and cannot, therefore, be invested.

For those individuals with large cash savings (over £50,000) and/or businesses that cannot make use of Premium Bonds, Cash Management Platforms may offer an alternative cash-like strategy.

What is a Cash Management Platform and what are the benefits of using one?

In simple terms, a cash management platform spreads the capital amongst different institutions and different accounts on your behalf.

The main benefits are two-fold:

1. ‘Increased’ Financial Services Compensation Scheme payment should things go wrong

The Financial Services Compensation Scheme protects customers from losing some of their cash if authorised banks (and other financial services firms) go out of business. It protects up to £85,000 of savings per individual, per financial institution.

For example, if a business has £500,000 in cash deposits, split between many bank accounts all with the same bank, and that bank goes bankrupt, the maximum the business could get back is £85,000. If that £500,000 is split amongst different banks, then the business would have the £85,000 protection with each financial institution. A Cash Management Platform automatically spreads the capital amongst different banks/financial institutions.

Whilst we do not believe any banks in the UK are going to go bust, we do appreciate that individuals who have large cash deposits are a lot more mindful of the possibility, in the wake of Lehman Brothers and Northern Rock going bankrupt in 2008/09.

We would therefore suggest that if you or your firm are saving large cash deposits for a specific reason, it is worth spreading it amongst different banks, not just different bank accounts.

2. Potentially higher interest rates

Some banks offer higher than average interest rates to attract more customers.

Instead of you searching the market every day for the best interest rates available, the cash management platforms do that on your behalf.

This means that you can access higher interest rates using a cash management platform, as opposed to a simple retail savings account.

At Lubbock Fine Wealth Management, we offer unbiased, independent financial advice, based on our assessment of your specific needs, concerns and objectives. Our advice will always be followed by a comprehensive and fair analysis of the whole market.

We offer a no obligation initial meeting where we can discuss your needs and advise how we can help you achieve your goals and objectives.

To arrange this please call our team on 0207 490 7766 or email our Chartered Financial Planner, Görkem Gökyiğit at GorkemGokyigit@lfwm.co.uk