COVID-19: New winter support measures for businesses and individuals

Lubbock Fine, 25 September 2020

Lubbock Fine, 25 September 2020

On 24 September 2020, the Chancellor Rishi Sunak delivered his Winter Economic Update, unveiling a new package of Government support for businesses and workers impacted by the COVID-19 pandemic.

You can read our round-up of the update below, which included both new schemes and changes to existing measures.

The announcement opened with details of the much-rumoured replacement to the Coronavirus Job Retention Scheme (CJRS).

The new Job Support Scheme will start on 1 November 2020 and last for six months. Aimed at SMEs facing lower demand over winter, the Scheme seeks to protect “viable” jobs, where employees are working fewer hours than normal due to decreased demand.

To qualify, employees must:

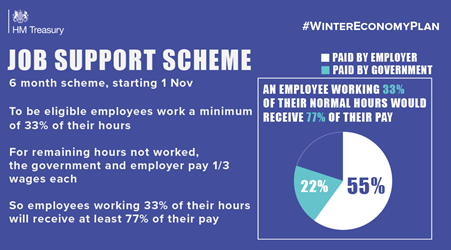

Employers will continue to pay the wages of staff for the hours they work. For the hours not worked, the Government and the employer will each pay one third of their equivalent salary. Therefore, an employee working 33% of their hours will receive at least 77% of their pay, with 55% of this amount paid for by the employer.

Source: HM Treasury

Employers bringing back workers from furlough can claim this alongside the Job Retention Bonus. Larger businesses may be eligible if their turnover has gone down during the pandemic.

Further details on eligibility and the application process are expected to follow soon.

It was confirmed that the Coronavirus Job Retention Scheme (CJRS) will still close at the end of October 2020, as previously stated.

Applications for the Government’s business loan schemes have been extended until the end of November 2020. These include:

Businesses repaying a Bounce Back Loan can benefit from the new Pay As You Grow flexible repayment scheme. The loan repayment period can be extended from six years to ten, reducing monthly repayments. Interest-only periods and payment holidays will also be available.

Lenders will also be given the ability to extend the maximum length of Coronavirus Business Interruption Loans from six years to ten years, where beneficial.

The Self-Employment Income Support Scheme will also be extended throughout the winter months.

Individuals must be currently eligible for SEISS and continuing to actively trade, but still facing decreased demand due to COVID-19.

There will be two additional taxable grants available, covering the periods of November 2020 – January 2021 and February 2021 – April 2021 respectively. These will be worth 20% of average monthly profits, up to a total of £1,875.

Self-assessment taxpayers will also have more time to pay their tax bills. Those with up to £30,000 to pay in January 2021 will be able to register online for a ‘Time to Pay’ plan over the following 12 months. This can include any liability that they have already deferred from 31 July 2020.

As is currently the case, other taxpayers may be able to agree a bespoke plan with HMRC’s Time to Pay team based on their specific circumstances.

Businesses that took advantage of the deferral for VAT payments due between 20 March 2020 and 30 June 2020 are no longer obligated to pay in full the VAT deferred by end of March 2021. There will be an option to spread the amounts due over the financial year 2021-2022. Businesses will need to opt in and will be able to do so in early 2021.

Instead, they can now choose a 12-month interest-free repayment plan, allowing them to spread the cost.

The temporary 5% VAT rate for the tourism and hospitality sector has been extended until the end of March 2021, as businesses in the sector continue to be heavily impacted by the pandemic. It was due to end on 12 January 2021, prior to these announcements.

If you need any assistance with navigating the changes, please speak to your usual Lubbock Fine contact, or get in touch here.