Sharon Parker, 20 November 2025

HMRC recently issued Revenue and Customs Brief 6 (2025). In this Brief they explain that there is now an opportunity for certain suppliers of insurance related services to recover VAT that was previously restricted following the implementation of anti-avoidance legislation in 2019. The anti-avoidance provisions were introduced to target the use of offshore looping arrangements in the insurance sector, which HMRC perceive constitute VAT avoidance.

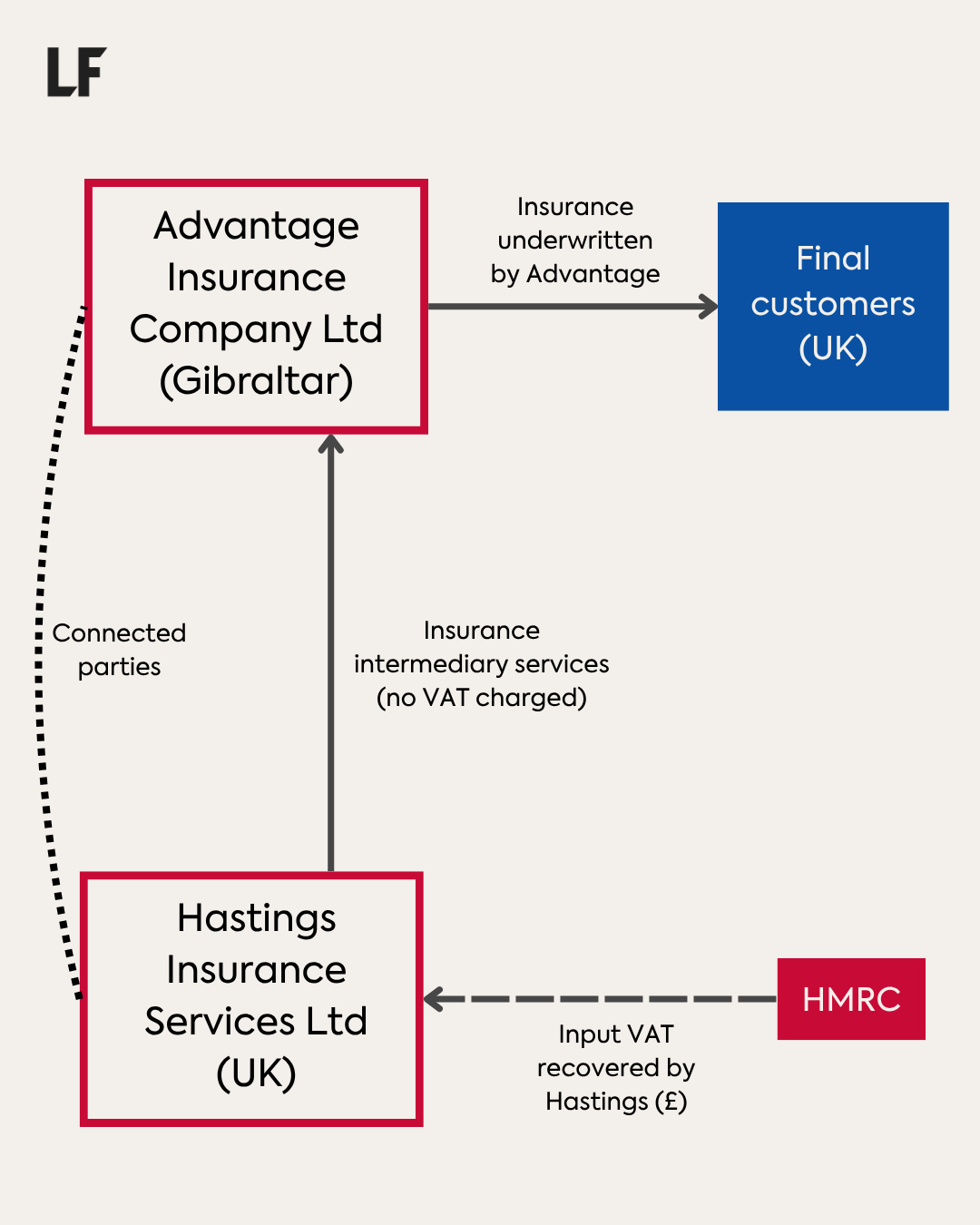

The high-profile VAT case of Hastings Insurance Services Ltd in 2018 highlighted the use of offshore looping arrangements in the insurance sector to recover otherwise irrecoverable VAT. Insurance services are treated as exempt for VAT. This means that ordinarily the attributable ‘input’ VAT that a business incurs in providing its services can’t be recovered. However, under special VAT rules for insurance services and other ‘specified supplies’ input VAT may be recovered where it is attributable to supplies made to recipients belonging outside the UK. Hastings structured its arrangements to benefit from these rules, even where the final insured customers belonged in the UK.

Hastings, which was based in the UK, acted as an insurance intermediary, providing services such as brokering and claims handling as well as other administrative services for the Hastings insurance group. The VAT it incurred in providing these services would not have been recoverable if the entity to which it supplied its services had belonged in the UK.

Advantage Insurance Company Ltd was a connected entity, which acted as the underwriter of the insurance supplied to the final customers. This entity was based in Gibraltar. Where Hastings supplied insurance intermediary services to Advantage in Gibraltar, it was able to recover the VAT it incurred in providing its intermediary services. This was because the supply chain effectively ‘looped’ the provision of insurance services offshore.

HMRC argued that the supplies made by Hastings to Advantage did not give rise to an entitlement to recover the attributable input VAT. However, the First Tier Tribunal disagreed with HMRC, ruling that Hastings was indeed entitled to recover the VAT it incurred in providing its services.

Following this case, HMRC introduced anti-avoidance legislation in 2019 which was aimed at countering the perceived VAT avoidance resulting from offshore looping arrangements in the insurance sector. The effect of this was that offshore looping arrangements can no longer be used to derive a VAT advantage where the insured final customer belongs in the UK.

In March this year, the First Tier Tribunal released its judgment in a second VAT case brought by Hastings. Hastings contended that the anti-avoidance provisions introduced by HMRC in 2019 were incompatible with the over-arching EU VAT Directive. The EU VAT Directive had direct effect and could be relied on by the taxpayer post-Brexit up until 1 January 2024. Once again, the tribunal found in favour of Hastings.

This means that for the period between 1 March 2019 and 1 January 2024, insurance intermediaries were entitled to recover VAT that had previously been restricted under the offshore looping anti-avoidance rules.

HMRC have advised that insurance intermediaries who were required to restrict their VAT recovery following the introduction of the anti-avoidance legislation should review their VAT position. Since any claims for under-recovered input VAT are subject to the normal four-year time limit, we would urge insurance providers to act fast. HMRC have confirmed that the anti-avoidance rules remain in place and that VAT recovery will continue to be restricted for arrangements affected by these rules after 1 January 2024.

The Lubbock Fine VAT team has extensive experience of advising businesses in the insurance sector. Please get in touch with Sharon Parker (sharonparker@lubbockfine.co.uk) if you would like to discuss any of the issues raised above. We will be happy to review your position and advise on whether you may be able to make a claim for under-recovered input VAT. We can also support you with preparing a claim and assisting with any partial exemption calculations that may be necessary.